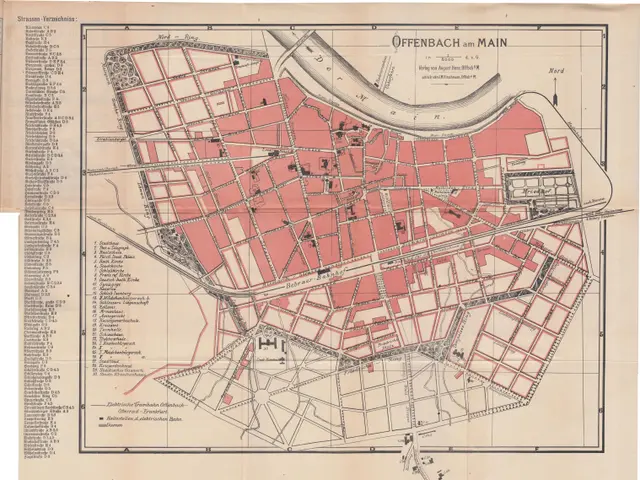

Worthington Steel Eyes Takeover of German Steel Giant Klöckner & Co

US Conglomerate Plans Takeover of Kloeckner & Co

Kloeckner & Co faces a possible takeover by Worthington Steel. Negotiations are ongoing, but the terms are still unclear.

2025-12-07T19:41:14+00:00

finance, business, technology, general-news

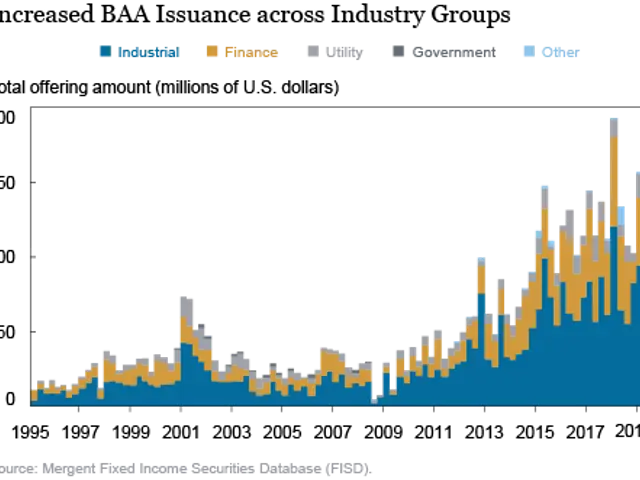

Major shifts are unfolding in both the steel and retail sectors. U.S.-based Worthington Steel is in talks to acquire German distributor Klöckner & Co, while Hornbach Holding has cut its financial forecast. Meanwhile, SpaceX is preparing for a high-profile stock market debut in 2026 with an eye-watering valuation.

Worthington Steel, led by President and CEO Geoff Gilmore, is exploring a potential takeover of Klöckner & Co. The deal could open new markets for the German company and create operational efficiencies. However, the terms remain undefined, and no formal bid has been confirmed.

The potential Worthington-Klöckner deal could reshape the steel distribution sector if finalised. Hornbach’s downgraded outlook reflects current market challenges, while SpaceX’s IPO plans signal confidence in its long-term growth. Each development points to significant changes ahead for the industries involved.