U.S. Hedge Fund Threatens Peru Over Unpaid 1970s Military Debt

A U.S. hedge fund, Gramercy, which specializes in emerging markets, is threatening legal action against Peru over unpaid military debt from the 1970s. The fund claims that the country's current repayment plan for the debt is insufficient. The dispute comes as global financial leaders gather in Lima for the World Bank and IMF Annual Meetings.

Peru's highest court ruled in 2013 that the government must honour the bonds but stopped short of ordering full repayment. Gramercy now argues that the existing terms are insufficient. If no agreement is reached, the fund plans to use the Investor State Dispute Settlement (ISDS) mechanism under the U.S.-Peru Free Trade Agreement (PTPA) to enforce its claims.

The PTPA, active since 2009, removes trade barriers and protects investors, intellectual property, and labour rights. It also strengthens environmental safeguards. Since the agreement took effect, U.S.-Peru trade has nearly doubled.

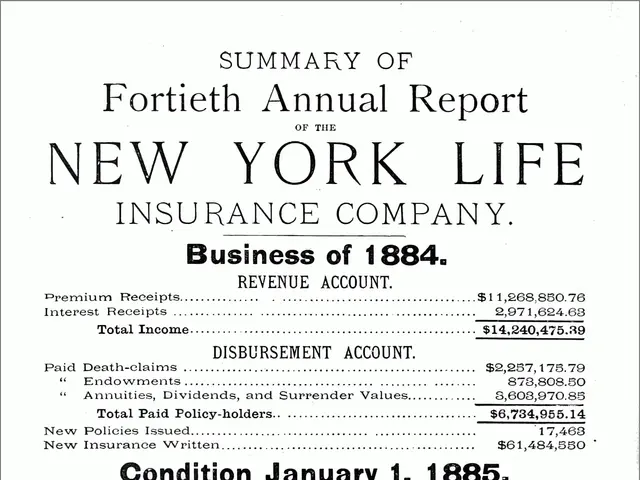

ISDS tribunals allow private firms to sue countries for breaching trade deals. If Peru loses, it could face economic sanctions. The threat arises as the country's economic growth slowed in 2014, hit by weaker global conditions and lower investment.

Gramercy's move puts pressure on Peru to renegotiate the debt terms. The case highlights how trade agreements like the PTPA can be used to enforce financial claims. A ruling against Peru could set a precedent for similar disputes in the future.