U.S. banks slash reserves, sparking a transatlantic regulatory showdown

U.S. banks are now lending more freely as interest rates fall and regulations ease. A recent shift in policy has reduced the capital they must hold as a safety buffer. This change is raising concerns among European bankers about fair competition across the Atlantic.

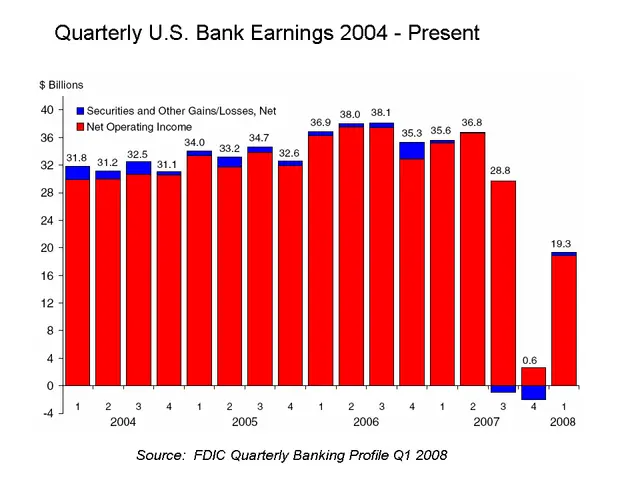

The relaxation of U.S. banking rules means institutions there will need to keep 15% less capital in reserve. This adjustment follows broader deregulation aimed at stimulating lending and economic growth.

European bankers have reacted with unease. Bettina Orlopp, CEO of Commerzbank, has urged EU regulators to reconsider their own strict requirements. She argues that Europe risks falling behind if it fails to adapt. Paul Maley, interim head of Americas at Alvarez & Marsal, echoed these concerns. He warned that European banks could face a competitive disadvantage unless the EU responds to the U.S. policy shift. The fear is that lighter regulations in America may give its banks an edge in global markets. The move has already led to more generous credit terms from major U.S. lenders like Capital One and Citizens Bank. Lower interest rates and reduced capital demands are making loans more accessible to businesses and consumers alike.

The U.S. banking sector is now operating under looser financial rules, with less capital tied up in reserves. European leaders are watching closely, weighing whether to adjust their own policies. The outcome could shape how banks like PNC Bank compete on both sides of the Atlantic in the coming years.