Swiss Franc hits all-time high against struggling Japanese Yen

The Swiss Franc has surged to a record high against the Japanese Yen this week. Analysts point to widening differences between the two economies and their central bank policies. Investors are increasingly favouring the Franc over the Yen amid growing uncertainty in Japan and Switzerland’s strong financial position.

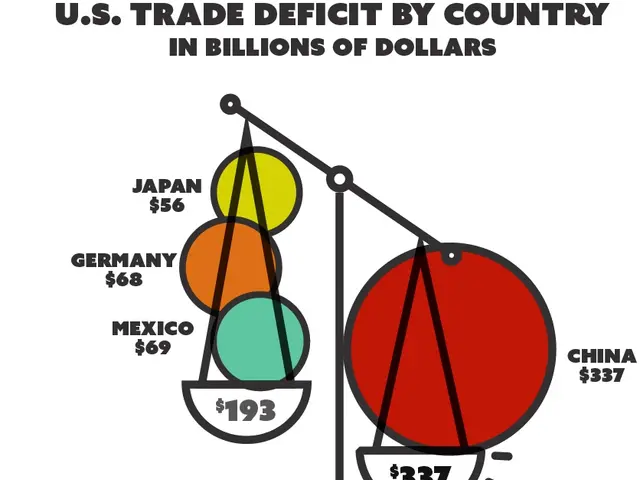

Japan’s trade balance has remained mostly in deficit since 2011, while Switzerland’s trade surplus continues to grow. This economic gap has contributed to the Franc’s strength against the Yen, now at an all-time peak.

Political instability in Japan has further weakened the Yen’s status as a safe-haven currency. Prime Minister Shigeru Ishiba’s recent resignation added pressure, making investors wary of holding Japanese assets. The Yen has become the worst-performing G-10 currency over the past three months. Central bank policies are also driving the divergence. The Swiss National Bank cut its key rate to 0% in June 2025, ending a period of negative rates that began in late 2022. Meanwhile, Japan’s negative real yields contrast with Switzerland’s mildly positive ones, making the Franc more attractive. Major banks are now betting on further gains for the Franc. Goldman Sachs and Bank of America strategists recommend going long on CHF/JPY, with Bank of America setting a target of 189. The Franc’s appeal stems from Switzerland’s robust fiscal health and a growing risk premium on the US Dollar and Yen.

The Franc’s rise reflects Switzerland’s strong economic fundamentals and Japan’s ongoing challenges. With political uncertainty and weak yields in Japan, investors continue to shift towards the Swiss currency. The trend is expected to persist as long as these conditions remain in place.