Stablecoin Rewards Face Fresh Pushback as Crypto Firms Press Senate Panel

A dispute over stablecoin rewards has intensified in Washington as crypto firms push back against proposed restrictions. Lawmakers are being urged to keep the current legal framework in place, with over 125 digital asset companies now involved in the debate. The issue centres on whether rewards on stablecoins should face tighter controls under the GENIUS Act.

The Bitcoin Policy Institute took an early stance in December 2022, sending a statement to the Senate Banking Committee. It argued for preserving the existing legal status of stablecoin rewards, warning that changes could harm market confidence.

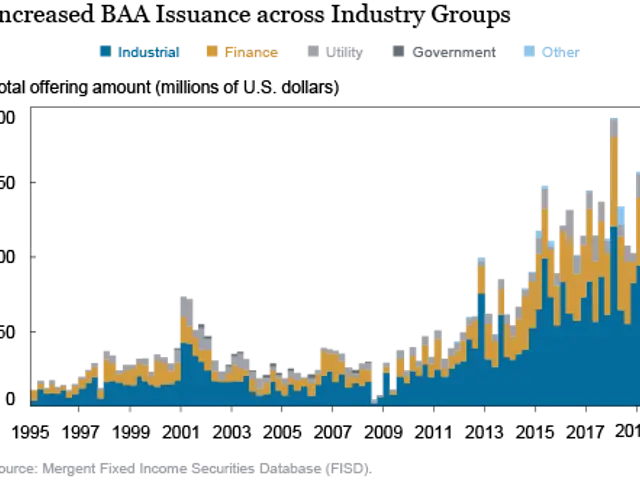

Crypto groups have since escalated their opposition, claiming renewed restrictions would protect banks at the expense of innovation. They accuse traditional financial institutions of defending their revenue models rather than addressing real risks. Economic data, including a Charles River Associates analysis and Federal Reserve figures, has been cited to support the case for stablecoin rewards. Banking groups, however, insist that third-party stablecoin rewards pose a threat to traditional deposits. They argue that such incentives could encourage consumers to shift funds away from banks, potentially destabilising the sector. Industry representatives now warn that revisiting the GENIUS Act’s interest ban would create uncertainty. They claim it could undermine trust in stablecoins and disrupt a rapidly growing market segment.

The Senate Banking Committee faces mounting pressure from both sides of the debate. Over 125 firms have called for the rejection of stricter stablecoin reward limits, while banks continue to push for tighter oversight. The outcome will determine whether the current legal framework remains or undergoes significant changes.