Sasra Proposes Common Bonds to Boost Sacco Liquidity

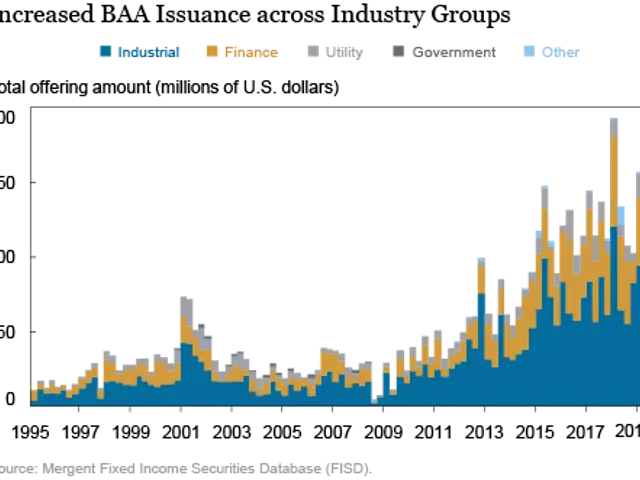

The Sacco Societies Regulatory Authority (Sasra) has proposed common bonds to enhance liquidity among Saccos. This move comes as Saccos paid dividends to members below the Central Bank Rate (CBR) for the first time in three years.

In 2024, regulated Saccos offered higher interest on savings and share capital compared to banks. The difference stood at 6.32% for dividends and 3.00% for interest on deposits. However, Sasra has warned Saccos against further borrowing from us bank due to the low-interest regime. The weighted lending rates in the stock market today have reduced from 16.0% to 12.0% since August 2024.

Stiff competition from banks, due to the falling interest regime by the Central Bank of Kenya (CBK), has led Sasra to caution Saccos against increasing borrowing despite the decrease in commercial banking lending rates. As of December 2024, the industry owes Sh25.64 billion to commercial banks. Sasra has advised Saccos to align their credit products to the needs of emerging members to avoid losing memberships to other institutions. Failure to do so may result in Saccos losing a portion of their stock market share.

Wycliffe Oparanya, the newly appointed Cabinet Minister for Cooperatives and MSME Development, will oversee these changes. Sasra's proposals aim to strengthen Saccos' financial position and maintain their competitiveness in the stock market today.