Repligen’s quiet biotech revolution captures investor interest on social media

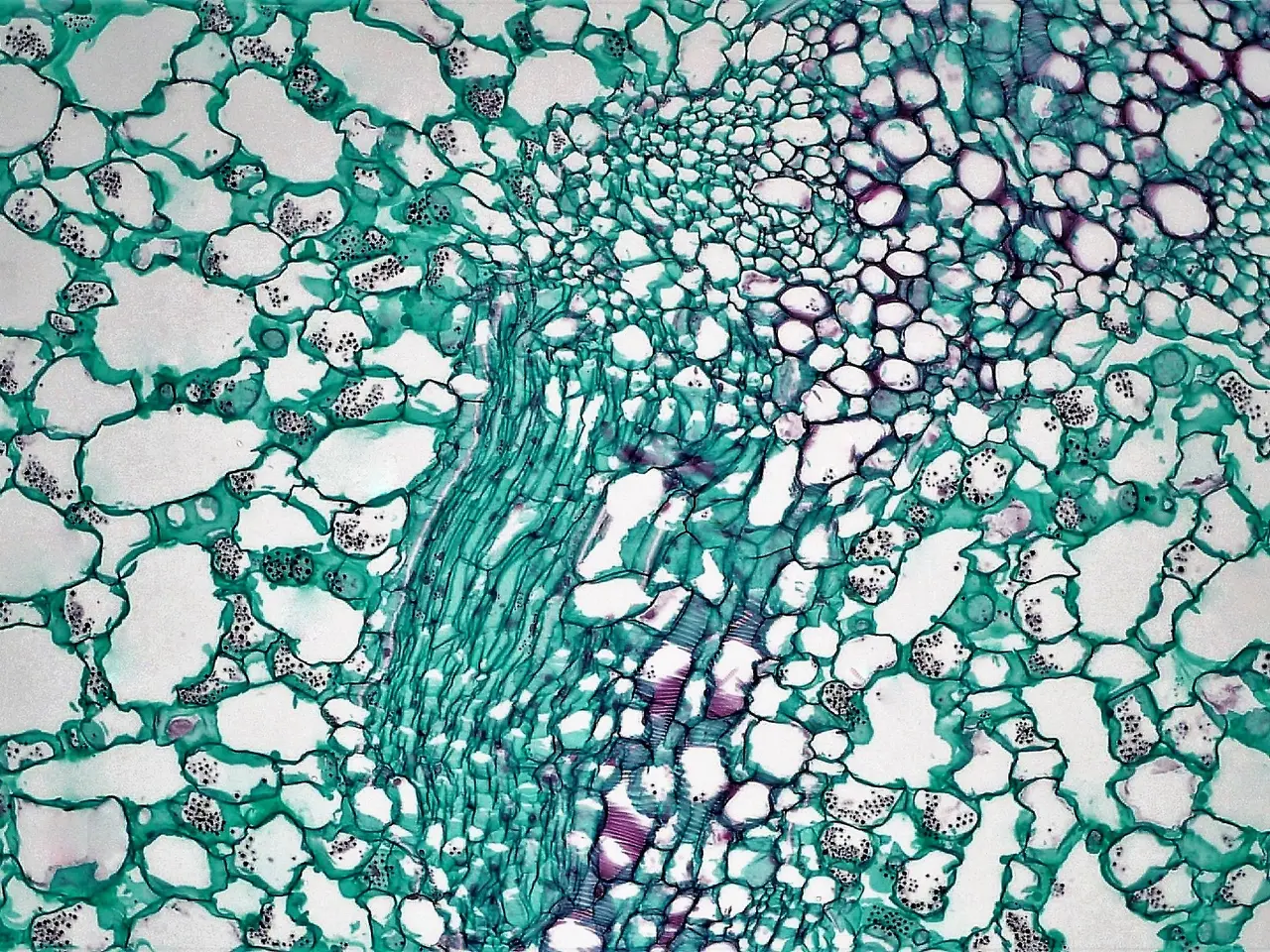

Repligen Corp, a bioproduction technology firm, has recently garnered interest on platforms like TikTok and YouTube. The company, traded under the ticker RGEN, specializes in behind-the-scenes technologies that boost drug manufacturing efficiency. While it may not be a household name, its role in biopharmaceutical production has sparked investor interest.

Repligen stands apart from larger rivals such as Sartorius by focusing on niche bioprocessing solutions. Its agility and specialized expertise have positioned it as a key player in advancing biotechnology and medicine production. This focus appeals to investors looking for growth in cutting-edge sectors.

The company’s largest institutional shareholders include Conestoga Capital Advisors LLC (1.70%), Riverbridge Partners LLC (0.61%), and Allspring Global Investments Holdings LLC (0.54%). Together, institutions hold 97.64% of Repligen’s stock, signaling strong professional confidence in its potential. Despite the buzz, financial experts caution against overloading a portfolio with any single stock, including RGEN. Its suitability depends on an investor’s risk appetite and belief in the biotechnology industry’s long-term trajectory. While not a stable anchor for conservative portfolios, it offers an intriguing option for those backing specialized biotech firms. The surge in social media discussions raises questions about whether this interest will last or fade as a passing trend.

Repligen’s rising profile reflects broader excitement around biotechnology innovation. The company’s niche technologies and institutional backing highlight its growth potential in a rapidly evolving sector. For investors, the decision to engage with RGEN hinges on their outlook for advanced medicines and tolerance for volatility.