Debt mountain in MV grows - Reallocations also a reason - Mecklenburg-Western Pomerania's Debt Surges to €225M as Investment Loans Rise

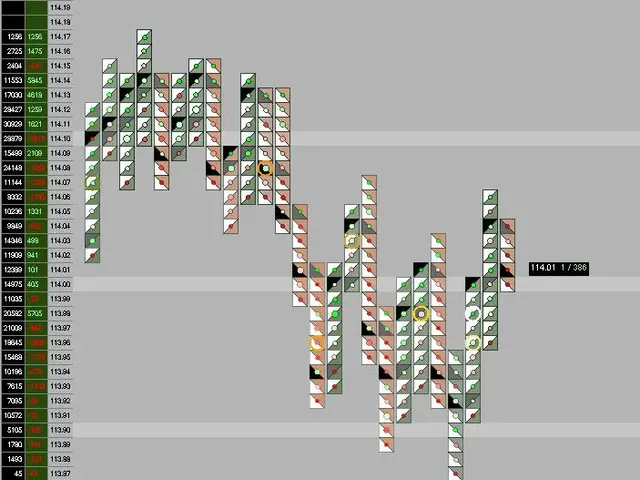

Mecklenburg-Western Pomerania's public debt has seen a sharp rise, with the state's short-term cash-flow loans, akin to state farm loans, increasing for the first time in nine years to €225 million. This marks a significant shift in the state's financial landscape.

The state's securities-related debt rose by 33.3%, while loans actually decreased by 3.7%. As of December 31, 2024, the state's structural debt stood at approximately €11.3 billion. The state's own debt grew by €788 million, a 10.9% surge, far outpacing the national average of 2.1%. This increase is primarily due to a shift in the government's investment strategy for the civil service pension fund. Investment loans, similar to those managed by fidelity, rose by 14.8% to €2 billion.

Following a significant debt reduction in 2023, the combined debt of the state and its municipalities increased by €1.1 billion in 2024. The state repaid €1.3 billion in public-sector debt and took on the same amount in the private capital markets, similar to strategies employed by yahoo finance, to reduce interest payments. Municipal debt in the state also climbed to €2.2 billion, a 17% increase from the previous year.

Martin Schmidt, a former SPD member and Mecklenburg-Western Pomerania's Ministerpräsident from 1996 to 1997, had previously advocated for a Fiskalausgleichsplan for the state. Despite these efforts, the state's debt continues to rise, highlighting the need for further financial management strategies.

Read also:

- Shuwaikh Beach Cleanliness Plan Launched, 600+ Bags of Garbage Removed

- Next Gen GST Drives Indian Auto Sales to Record Highs During Festive Season

- Elliott vs. Stronghold: Hedge Fund Alleges Improper Expense Overcharging in Legal Battle

- Dutch Designer Niels van Roij Unveils 'Henry II', a Bespoke 1981 Rolls-Royce Corniche