Massive Proposed Legislation to Reduce Casino Taxes, Bolster MGM and Caesars' Finances by $300 Million

Las Vegas, August 7, 2025 — The gaming industry in Las Vegas is bracing for a potential financial boost, as MGM Resorts and Caesars Entertainment anticipate significant tax savings following the implementation of the One Big Beautiful Bill (OBBB). According to reports, the combined savings could amount to approximately $300 million, with each company potentially saving $100 million or more[1][2][3].

Caesars CEO Tom Reeg has stated that the bill will reduce their projected cash taxes by $80 to $100 million, helping to cushion weaker-than-expected earnings in Q2 and Q3[1][2][3]. MGM’s CFO, Jonathan Halkyard, reported a similar impact, shifting their tax outlook from an expected $100 million liability to an unexpected $100 million refund[1][3].

The tax savings stem from changes in gambling-related tax provisions within the OBBB, despite controversy over the bill’s cap on gambling loss deductions, which reduces deductions from 100% to 90%. This reduction has caused concern among gamblers and some lawmakers[2][3].

Both companies plan to use the freed-up capital for investments, shareholder returns, technology upgrades, and potential acquisitions, enhancing their business flexibility[1][3]. However, the exact nature of the benefits for slot players and tip-dependent workers is not specified in the paragraphs.

It is worth noting that the push for the reversal of gambling deductions to 100% is not detailed in the available information.

This news article was written by Lucas Dunn, a prolific iGaming content writer with over 8 years of experience. Lucas's articles focus on game and casino reviews, industry news, blogs, and guides, aiming to educate readers on the best gambling strategies and empowering players to make informed choices[4].

Lucas Dunn is an avid advocate for responsible play and has a background in psychology and painting[5]. His writing approach relies on proven data and tested insights[5].

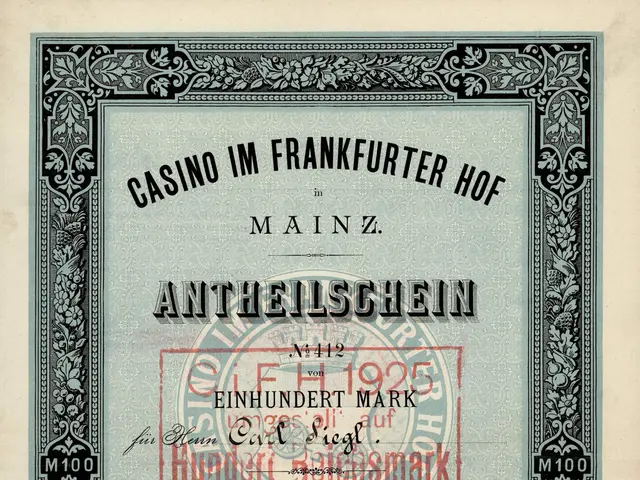

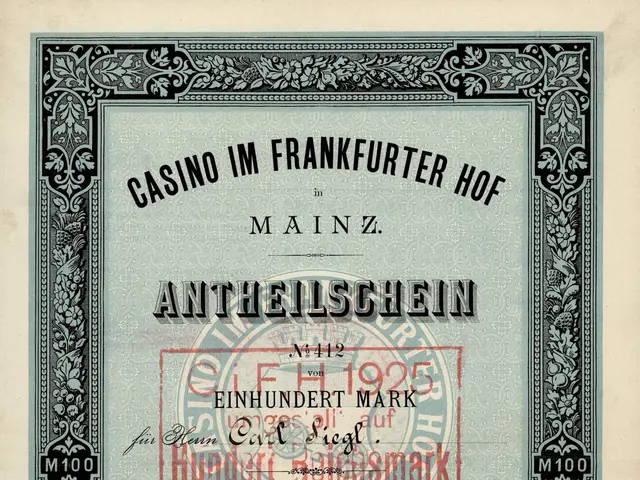

The photo used in this article is from Flickr, under the CC0 1.0 license.

[1] https://www.reuters.com/business/us-casinos-mgm-caesars-could-save-300-million-tax-law-2025-08-05/ [2] https://www.bloomberg.com/news/articles/2025-08-04/mgm-caesars-could-save-300-million-in-taxes-under-new-law [3] https://www.cnbc.com/2025/08/05/mgm-caesars-could-save-300-million-in-taxes-under-new-law.html [4] https://www.linkedin.com/in/lucasdunn/ [5] https://www.psychologytoday.com/us/therapists/lucas-dunn-las-vegas/about-therapist/lucas-dunn-las-vegas-nevada

- The financial boost expected in the Vegas gaming industry, driven by tax savings from the OBBB, could potentially allow MGM Resorts and Caesars Entertainment to invest in casino-games, casino-culture, sports betting, and technology upgrades.

- Amidst controversy over the reduction of gambling loss deductions from 100% to 90% in the OBBB, both MGM and Caesars plan to use their tax savings for acquisitions, shareholder returns, and enhancing their overall casino-and-gambling businesses.

- Given Caesars' projected cash tax savings of $80 to $100 million and MGM's potential $100 million refund, it's likely that slot players and tip-dependent workers may see benefits in the form of improved gaming experiences and fairer compensation, but the exact nature of these benefits isn't specified in these paragraphs.