How Blockchain and AI Are Fighting Billions in Financial Fraud

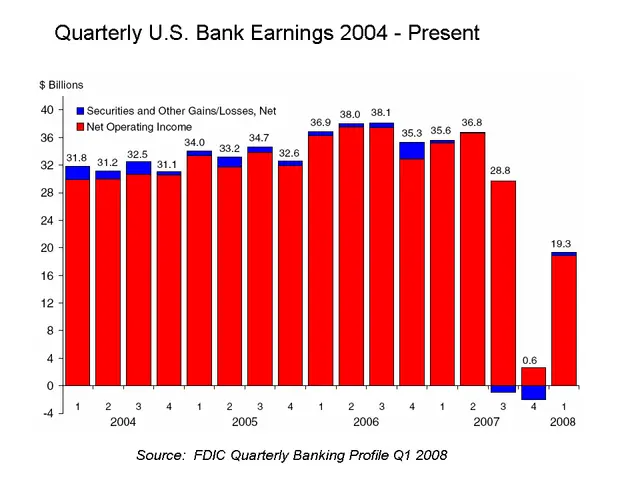

Fraud in car loans and company invoices is costing the financial industry billions each year. The problem stems from outdated systems that fail to share records instantly, allowing dishonest borrowers to reuse the same assets multiple times. Now, banks and tech firms are turning to blockchain, AI, and Big Data to close these loopholes and secure transactions more effectively.

Current financial systems rely heavily on paperwork, separate databases, and manual checks. This setup makes it easy for fraudsters to exploit gaps—such as duplicating vehicle identification numbers (VINs) or submitting the same invoice to multiple lenders. These deceptive practices lead to massive annual losses, as lenders struggle to verify asset ownership in real time.

Blockchain technology offers a solution by creating a shared, unchangeable ledger of transactions. Once an asset—like a car or an invoice—is recorded, it cannot be pledged again without detection. Platforms such as HQLA X and J.P. Morgan’s Onyx are already using this approach to manage securities and complex deals more securely. Big Data and AI add another layer of protection. Big Data systems gather and cross-check information from various sources, spotting inconsistencies in loan applications or asset valuations. Meanwhile, AI-powered Early Warning Systems analyse patterns to flag suspicious activity before fraud occurs. Together, these tools could cut collateral fraud by as much as 80%. Major institutions are already adopting the technology. V-Bank now offers tokenised funds and crypto securities under MiCAR licensing, while JPMorgan’s Kinexys infrastructure handles tokenisation and settlements. BNY Mellon has also introduced tokenised bank deposits for institutional clients since early 2026. DeFi platforms like Ondo Finance, Aave, and Compound further expand these capabilities with decentralised lending and tokenised investment products. For the system to work fully, legal frameworks must evolve. Regulators need to recognise digital tokens as valid collateral, ensuring these innovations comply with financial laws.

The shift toward blockchain, AI, and Big Data could transform financial security. If widely adopted, these technologies may unlock $50 trillion in tokenised lending while drastically reducing fraud. Success, however, hinges on updated regulations and industry-wide collaboration to integrate the new systems smoothly.