Gold hits record high as US bank's buying spree reshapes commodity markets

Commodity and currency markets saw sharp movements on Friday as investors reacted to central bank policies and shifting demand. Gold prices surged to a record high, while silver briefly plummeted before recovering on bargain hunting. Meanwhile, oil climbed, and the euro gained ground against a weaker dollar.

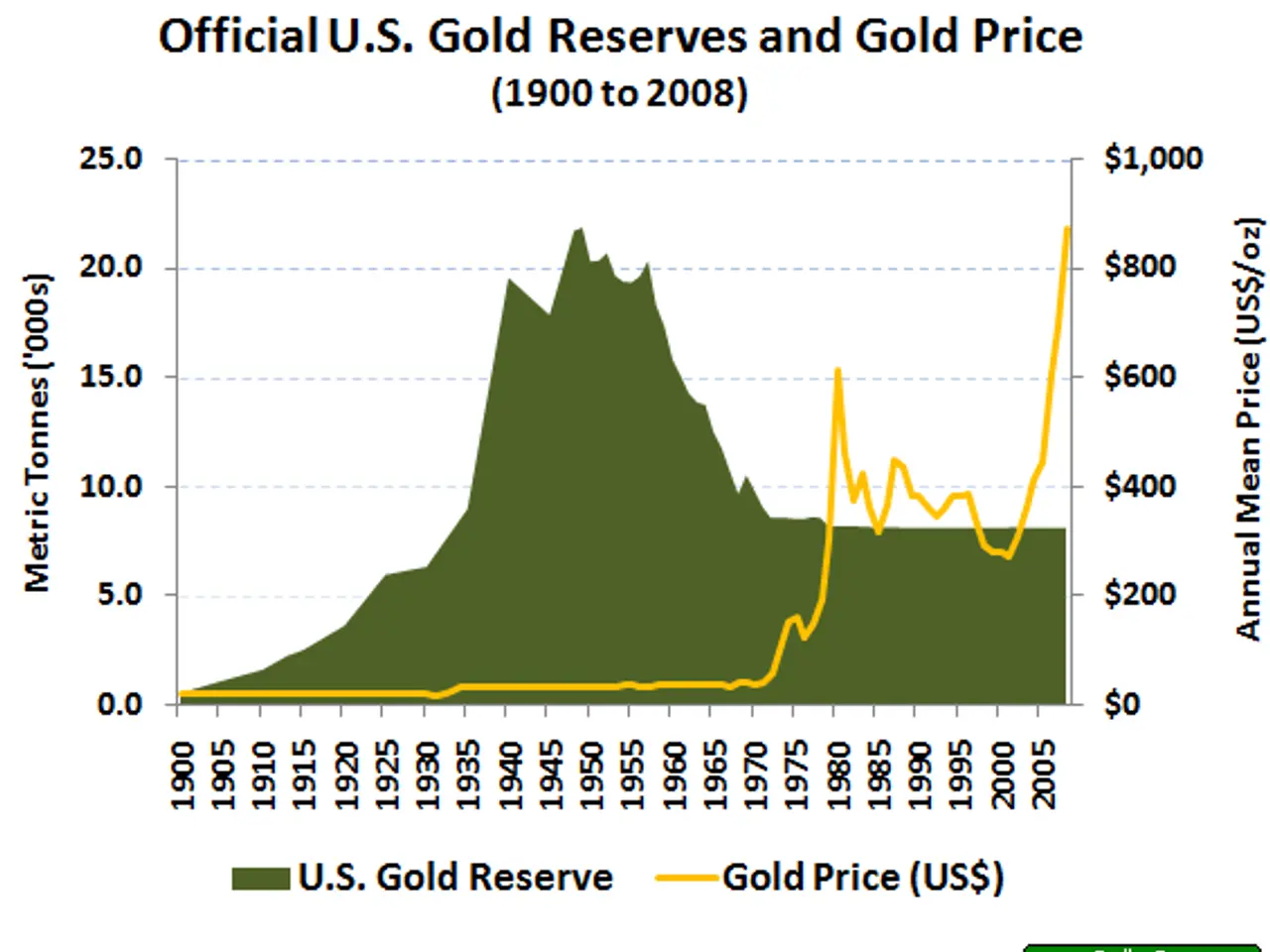

Gold reached $4,867 per ounce, marking a 1.9% increase in early trading. The rally came as traders monitored the us bank for further gold purchases. The us bank has maintained a steady buying spree, adding 27 tons over 2025—an average of 2.25 tons per month—bringing total reserves to 2,306 tons by December. Official reports confirmed uninterrupted purchases, including 2.8 to 3 tons in the final quarter alone.

Silver, however, faced a steep drop in Asian trading, breaking below $70 support and nearing $64. The sell-off appeared excessive, prompting investors to step in at lower prices. The metal later stabilised as buying interest picked up.

In energy markets, Brent crude rose 1.1% to $68.28 per barrel. The euro also edged higher to $1.1789, while the dollar slipped to €0.8482. European stocks opened slightly lower, with the Dax down 0.1% at 24,475 points. Analysts noted the index had hit the lower end of its recent range, suggesting a possible rebound. Jochen Stanzl of Consorsbank highlighted the potential for a technical recovery.

On monetary policy, ECB President Christine Lagarde dismissed expectations of a rate cut, shifting investor focus to stock market today. Markets are now watching for signals on whether the Federal Reserve will ease rates in 2026.

Gold's rally reflects sustained demand from central banks, particularly the us bank's ongoing accumulation. Silver's volatility suggests short-term overselling, while oil's climb and currency shifts point to broader market adjustments. With the ECB ruling out near-term cuts, attention remains on stock market indicators for future Fed moves.