Germany's Bundesbank breaks tradition with conditional backing for eurobonds

A shift in Germany's stance on eurobonds has emerged after years of resistance. Joachim Nagel, head of the Bundesbank, now supports issuing more joint EU debt—but only under strict conditions. His proposal clashes with both French President Emmanuel Macron's broader call for sector-specific eurobonds and German Chancellor Friedrich Merz's preference for limiting such debt to emergencies.

The debate over eurobonds has long divided Europe. Southern governments have pushed for shared borrowing to fund growth, while northern states, led by Germany, opposed it. Past crises like the ESM and EFSF saw Berlin reject joint debt, a position upheld by former Bundesbank chief Jens Weidmann. Now, Nagel has broken from tradition, arguing for targeted eurobonds to strengthen Europe's economic security.

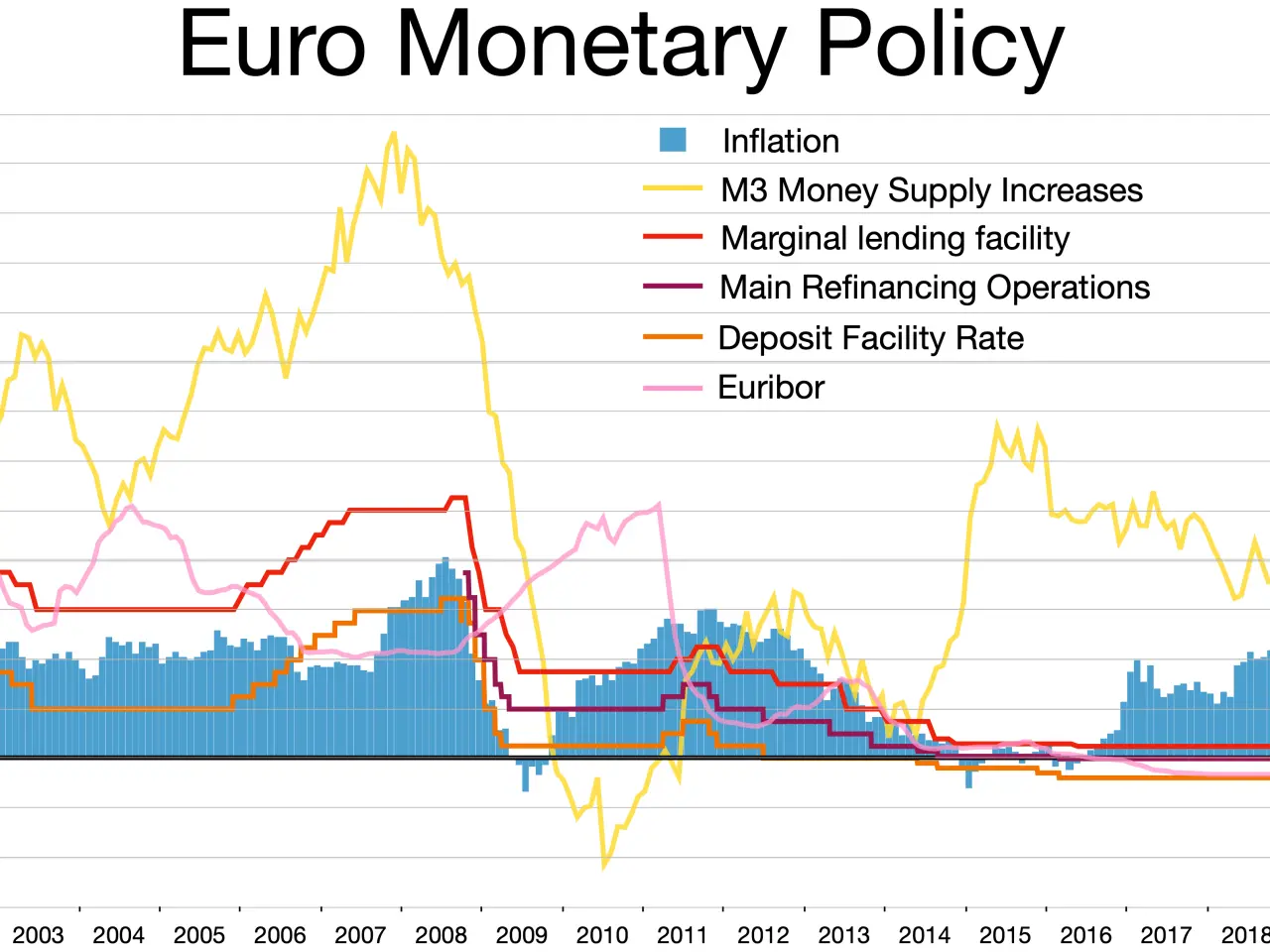

Nagel ties his support to two key goals. First, he wants joint debt to create a liquid market for safe European assets, attracting foreign investors. Second, he insists on maintaining strict controls, ensuring debt is used for specific purposes—similar to exceptions made for the EU's Corona recovery fund and Ukraine financing. He also warns that national debt reduction must accompany any new borrowing, calling it a necessity rather than a 'free lunch.'

Beyond debt, Nagel is pushing for Europe to reduce reliance on external financial systems. He advocates breaking the dominance of U.S. credit card firms in payments and expanding the ECB's liquidity lines to global central banks. This would help secure euro access for companies during crises. His stance reflects a broader trend among eurozone central bankers, who now see joint debt as essential to competing with the U.S. and China.

Yet Nagel's position has sparked tension within Germany. Chancellor Merz remains firm that eurobonds should stay reserved for emergencies, while the Bundesbank's new openness marks a clear departure from its historical scepticism.

The Bundesbank's conditional backing of eurobonds signals a turning point in Europe's financial policy. If adopted, the move could reshape how the EU funds its priorities, balancing economic growth with stricter oversight. The disagreement between Nagel and Merz, however, highlights the challenges ahead in reaching a unified approach.