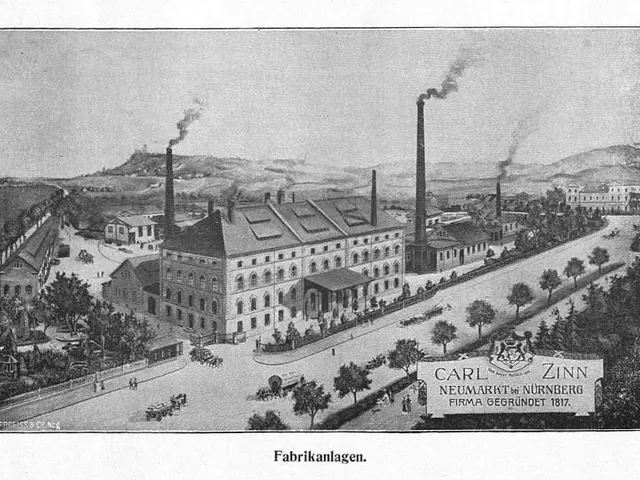

Restaurant and hotel sales drop in August - German Hospitality Sector Sees August Revenue Dip Amidst VAT Cut Talks

August saw a dip in revenue for Germany's hospitality sector, with restaurants, bars, and hotels all reporting decreases compared to last year and the previous month. While no plans are in place to reduce VAT on food, discussions are ongoing about tax cuts in the gastronomy sector.

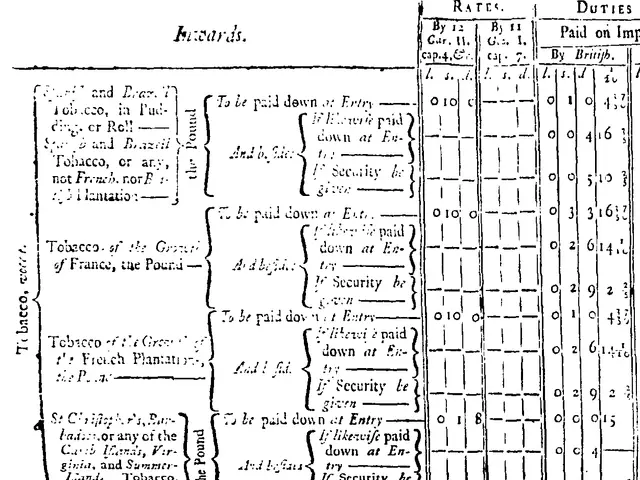

The German government has not yet announced plans to lower the VAT rate on food, which remains at 19%. However, talks are underway to reduce VAT in other areas, such as the gastronomy sector. From January 1, 2026, VAT on food and non-alcoholic beverages in restaurants and bars will decrease to 7%.

In August, the sector faced a 3.7% revenue decrease compared to the same period last year. Month-on-month, revenue dropped by 0.6% from July. Hotels and accommodation providers also saw a 3.7% year-on-year revenue decrease and a 1.8% decrease from July.

Despite the recent revenue drops, the catering industry anticipates a VAT reduction on food next year. This could potentially boost revenue and ease the burden on businesses in the sector.

Read also:

- Shuwaikh Beach Cleanliness Plan Launched, 600+ Bags of Garbage Removed

- Next Gen GST Drives Indian Auto Sales to Record Highs During Festive Season

- Elliott vs. Stronghold: Hedge Fund Alleges Improper Expense Overcharging in Legal Battle

- Dutch Designer Niels van Roij Unveils 'Henry II', a Bespoke 1981 Rolls-Royce Corniche