Bankrupt KMUS-2 LLC’s assets auctioned off at steep discounts in final liquidation

The assets of bankrupt construction firm KMUS-2 LLC have been sold off in a series of public auctions. The company, which once worked on the Tuapse Refinery reconstruction, collapsed in 2023 with debts of 5.7 billion rubles. Among its largest creditors was oil giant Rosneft.

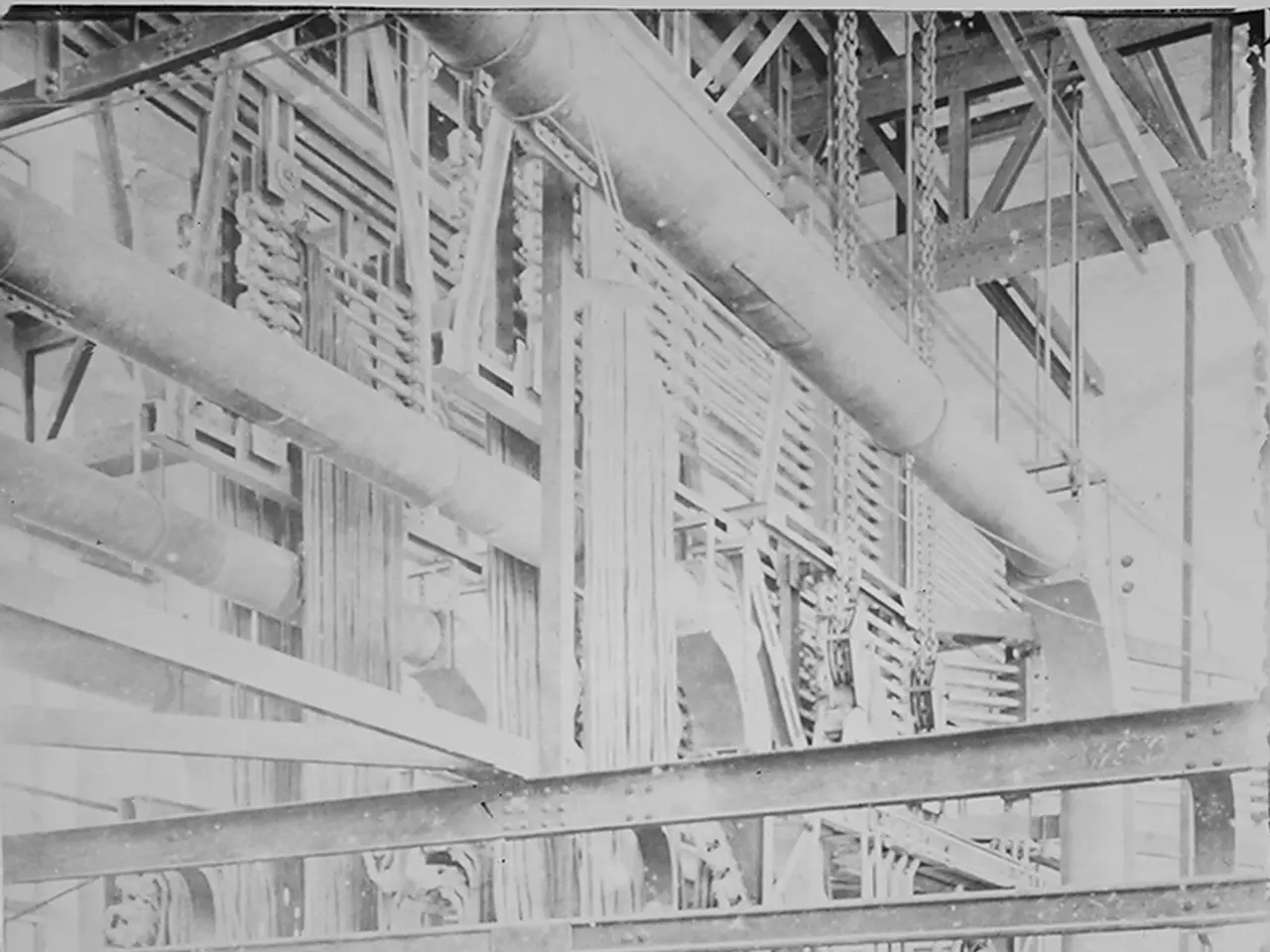

The liquidation process began in the summer of 2025, with assets initially valued at 1.1 billion rubles. One of the key sales was a pipe assembly production base in Afipsky, purchased by Metallotorg PJSC—a wholesale metal trader—for 192 million rubles. The price represented a steep discount, as the starting bid had been set at 340 million rubles.

Other properties, including a Krasnodar complex, were also auctioned as part of the bankruptcy proceedings. The sales follow KMUS-2 LLC’s financial collapse, which left major creditors like Rosneft seeking recovery. Meanwhile, Russian exchanges reported a surge in mineral fertiliser trading during 2025. Volumes doubled to 294,000 tons, though this growth was unrelated to the KMUS-2 liquidation.

The auction of KMUS-2 LLC’s remaining assets marks the final stage of its bankruptcy. The proceeds will go toward repaying creditors, including Rosneft, though the total recovered remains far below the 5.7 billion rubles owed. Metallotorg PJSC now owns the Afipsky production base after securing it at less than 60% of its starting price.