Axis Bank's digital push and credit boom fuel growth in India's tough market

Axis Bank has strengthened its position in India's competitive banking sector. The institution's recent growth stems from rising credit demand, digital expansion, and improved financial health. Despite market volatility, its performance has outpaced broader trends in the Indian stock market today over the past year.

The bank's success reflects a mix of economic tailwinds and internal strategy. A growing middle class and increased digital adoption have fuelled demand for financial services. Axis Bank has responded by expanding its digital channels, making transactions faster and more accessible for customers.

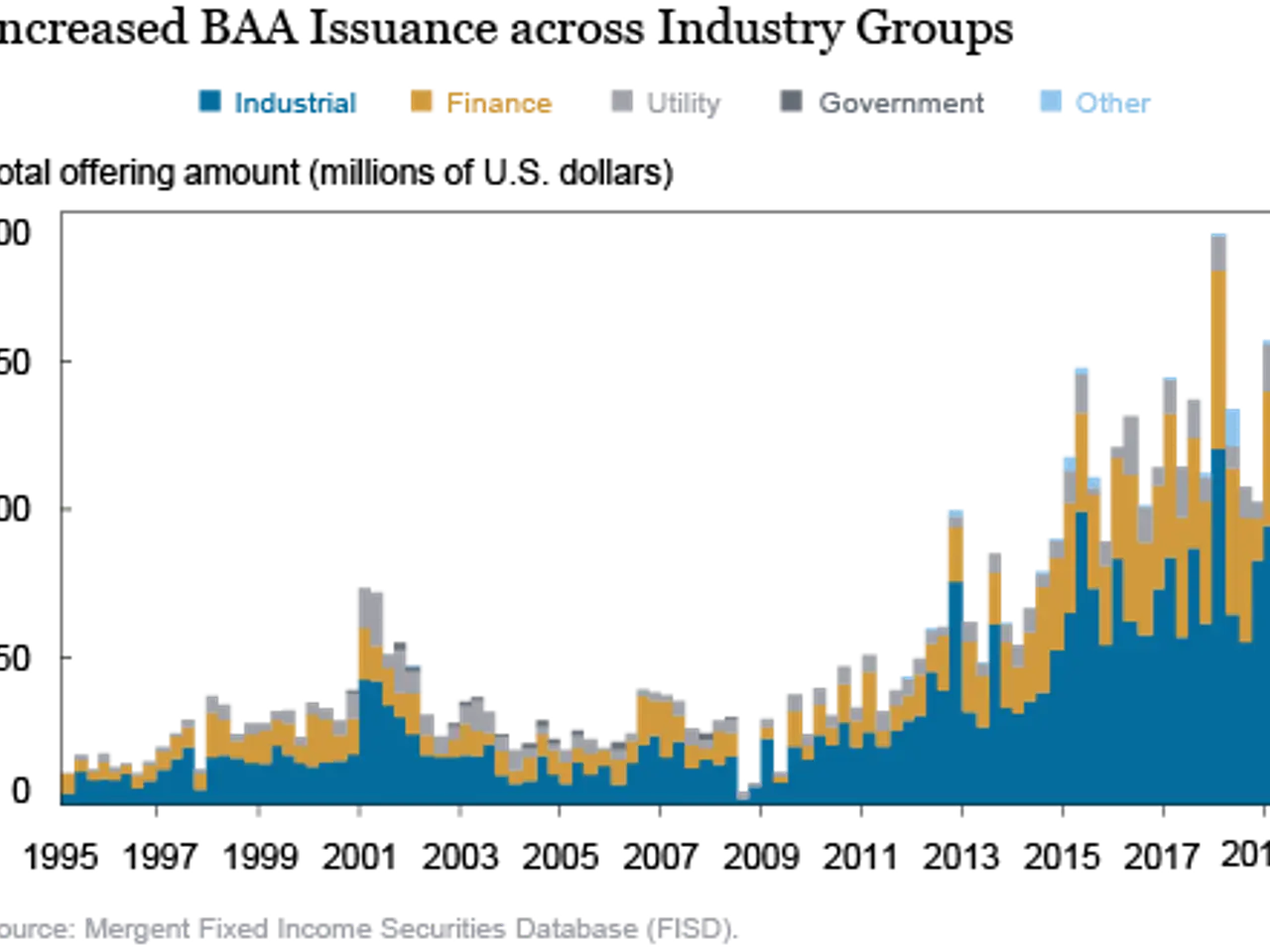

Loan volumes have climbed in both corporate and retail banking. This surge aligns with India's broader credit growth, supported by a tech-savvy population. At the same time, the bank's non-performing loan ratio has steadily declined, a trend analysts have highlighted as a sign of stronger asset quality.

Earnings have also improved, driven by higher net interest and fee income. While rivals like HDFC Bank and ICICI Bank maintain larger market shares, Axis Bank has carved out its own space in retail banking. Over the last five years, however, HDFC Bank has led in market capitalisation growth, followed by ICICI Bank, with Axis trailing due to competitive pressures from the stock market today.

Axis Bank's focus on digitalisation and credit expansion has paid off in a dynamic market. The bank's declining bad loans and rising earnings suggest a stable foundation for future growth. Yet investors remain cautious, weighing its potential against ongoing volatility and competition from larger players in the stock market today.