ACCC blocks IAG’s $2.3B RAC Insurance takeover over competition fears

The Australian Competition and Consumer Commission (ACCC) has blocked IAG’s proposed takeover of RAC Insurance Pty Limited (RACI), arguing it would weaken competition in Western Australia's insurance market. IAG has confirmed it will seek a review under new merger rules coming into force next year.

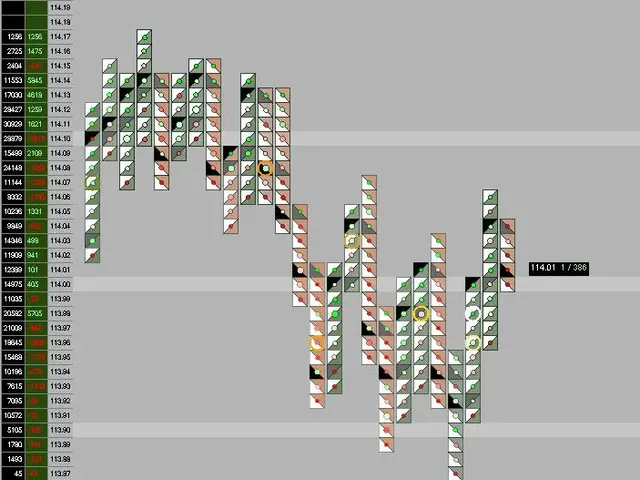

The ACCC's decision is based on concerns that the acquisition would give IAG too much control over WA's insurance sector. Currently, IAG holds around 22% of the market in RACI's sales region. If approved, its share would jump to roughly 38%. In the stock market of motor vehicle insurance, the combined entity would dominate with 55-65% of the shares. For home and contents insurance, the figure would reach 50-60%.

ACCC Chair Gina Cass-Gottlieb warned the deal could lead to higher premiums and lower-quality products for consumers. She also noted that RACI remains a strong, profitable competitor on its own. The regulator believes the company can continue operating effectively without being absorbed by IAG.

IAG, however, has stressed its long-standing partnership with RAC and its commitment to improving services for members. The insurer pledged to keep operations local and invest in better customer experiences. It also promised to maintain competitive pricing and product quality if the deal eventually goes ahead.

Despite the setback, IAG plans to challenge the decision. The company will apply for reassessment once Australia's new mandatory merger control regime begins on January 1, 2026.

The ACCC's ruling means IAG's bid for RACI is on hold for now. If the acquisition fails, WA's insurance market will retain its current competitive structure. Should IAG succeed in its appeal, the deal would reshape the sector, giving the company a far larger share of motor, home, and contents insurance.